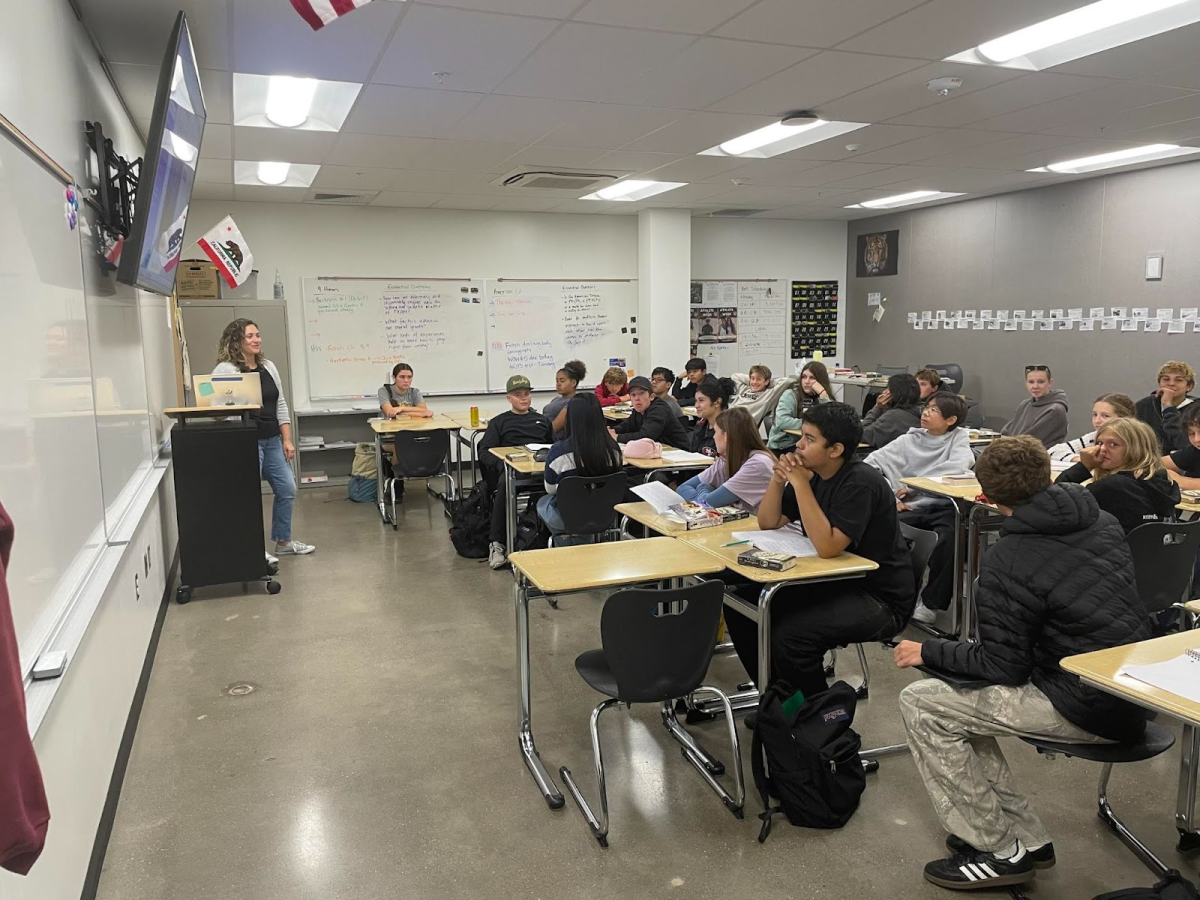

Photo courtesy of freshman Phoebe Drazsnzak.

San Luis Obispo High School students all like nonprofit organizations, we have at least thought about donating to them. A nonprofit is an organization that does not make any money and is usually devoted to helping others in need.

Some students at SLOHS decide to go the extra step and create one. Have you ever thought about what’s behind it, what these people who are striving to make a difference go through?

Expressions set out to find the answers.

For some SLOHS students, nonprofits mean a lot to them.

“I volunteer at the local Cal Poly Cat Program, which is a non-profit and student run organization on campus,” said senior Nina Ramezani.

Interested students might start by searching “how to start a nonprofit organization in the state of California”.

One would have to go through the tedious process of drafting and filing the articles of incorporation where someone has to go through some legal work.

There would be a person who can receive lawsuits and other official matters. This could be the one who is creating the nonprofit this in no way means that person owns it, a nonprofit organization can not be owned.

However, that person’s name could come up in conversations about it. When forming the articles of incorporation, one could always find an outline of it on the secretary of state’s website.

A good next step would be to appoint the board of directors. In most cases, the board of directors is three or more people such as Connecticut. In some states, such as California one could have, me, myself and I.

Next one could draft the bylaws and meet with the Board member if there is more than just one person.

There are five forms to file/apply for: The first one being the EIN which is used for the purpose of tax administration.

Next, file for the CT-1 which will help report taxes. After that, file for the SI-100 which will verify the non-profits address, apply for the federal tax exemption which to sum it up it will make one not have to pay taxes, and finally, they would apply states tax exemption which is similar to the federal tax exemption but will cost around $400 but a non-profit organization will never have to pay taxes again.

“I did volunteering last year during COVID-19 and I am impressed by anyone who has started a nonprofit,” said freshman Phoebe Drazsnzak.

Starting a nonprofit is a tedious task but when done one is left with something amazing. Some students at SLCUSD have goals to do the same.

Source: upcounsel.com